Swing Trades

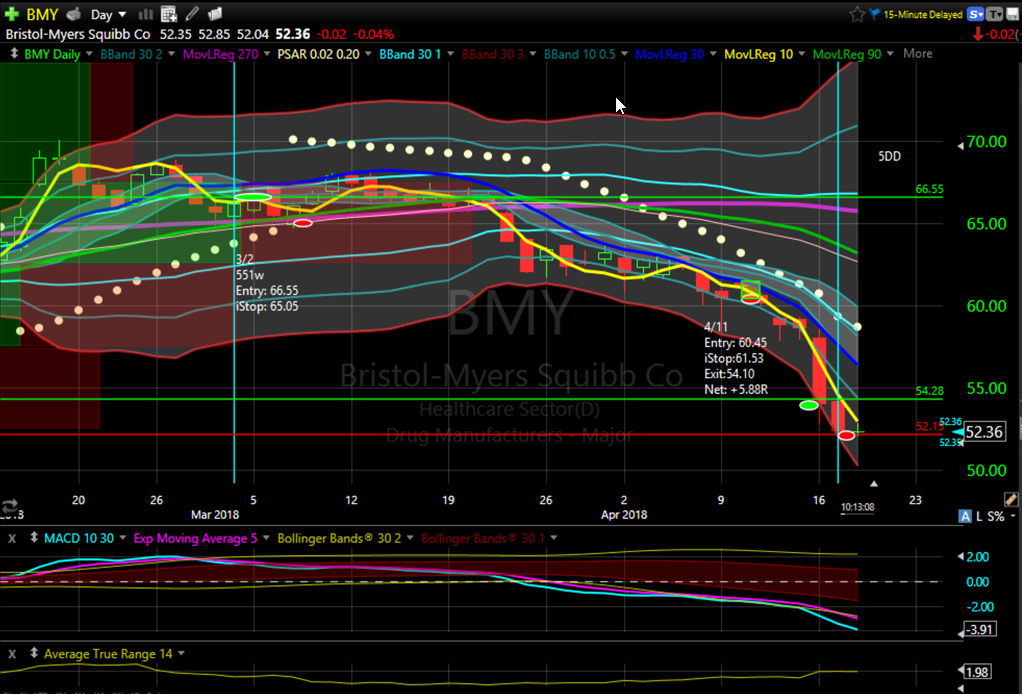

I framed two swing trades for possible execution today. Both were filled: BMY and O.Three channel trades reach their exit point today, so were closed out (one was a double position). Charts for NKE, SBUX, and XRT posted below.

Two other trades hit their stop losses today: BABA and JNJ.

Net result for closed trades: +2.54R. Current portfolio has 24 open positions showing +4.7R:

Long: AA(2), AAPL, BMY, EEM(2), EQR, EWG, ILF(2), INTC(2), KR, LRCX(2), O, RL(2), XLF.

Short: AEM, NYT, MO, PG, TSLA.

Day Trades

I was not able to trade the opening hour, but did trade an hour or so before lunch and again later in the afternoon. I ended up taking 20 trades generating +1.55R. Slightly better results than yesterday, and certainly better on the loss side as my largest loss was -.73R. I placed orders in the market today to make sure if it made a new high and I was short, I changed direction. It meant I bought the bar with the morning high, but I also recognized this and exited that position fairly quickly. While the reversal there would have been a great longer term trade, I was on edge and ended up only claiming little bits and pieces of what could have been a +2R trade had I held for just one hour. Being able to hold a position like that is my goal and what I am working towards. It seemed the market needed just a little more patience than I had today as it often made a significant move in the direction of my trade just after I exited.