Learning the platform

While I have not solved my initial frustration with the TradeStation platform, I have learned my way around the platform well enough to begin generating Strategy Performance Reports and backtesting strategies on baskets of stocks using Portfolio Maestro.

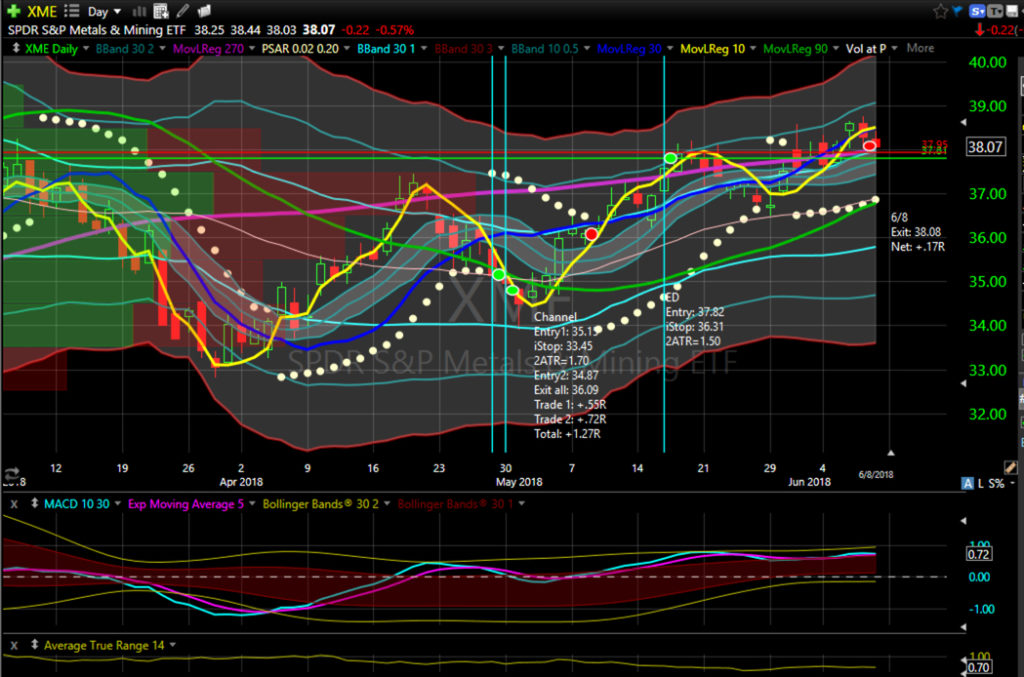

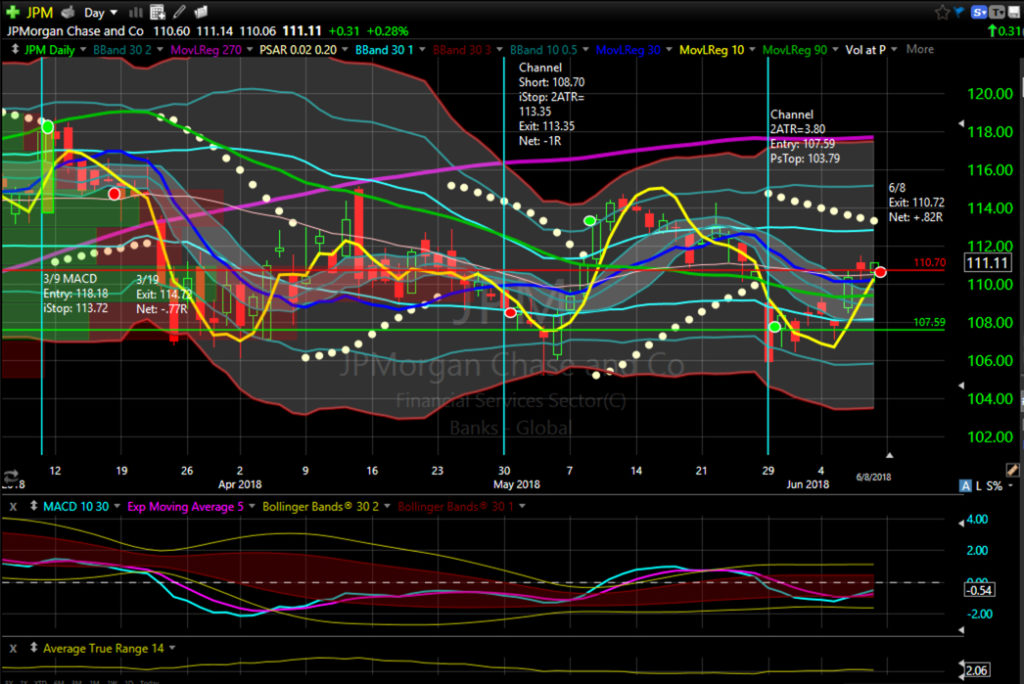

The basis for my swing trading I learned from Ken Long of Tortoise Capital Management, initially through a workshop at the Van Tharp Institute. Bill Brower of insideedge.net programmed Ken’s systems for TradeStation and I have installed the first bundle to begin my testing. Just seeing the inputs and variables Bill Brower offers for the systems has helped me understand the platform better.

Backtesting Questions

There are several questions to answer in evaluating backtests. The first one for me is to decided what is the universe of stocks that I wish to test. Should I use the Dow 30? S&P 100? S&P 500? A set of ETFs? A personalized list of targets? The trading universe will be the first determinant in how many trade signals I have to take. More stocks will yield more signals, but will also likely yield more losing trades. How many different targets can I trade based upon my current account size?

The next important question to settle is how far back I should test. Until early 2018, we were in a long slow-grinding up market. If I only look at the last couple of years, the results will likely be biased by the market condition. What period of time do I need to test in order to make sure I have representation for different market conditions?

Design features

The bundle of Ken Long’s systems provided by Bill Bower offers a bet sizing algorithm and an exit plan as part of each strategy. While useful and necessary in order to have a complete system, I am interested in other options than what are included. This will likely mean I end up coding my own version of the systems to meet my specifications. I believe Portfolio Maestro will override the money management (bet sizing) setting from the strategy, but I’m not really happy with the options it offers either. This may be one of the more difficult items for me to sort out.

The exit strategy seems to be a little easier to work around. There is an initial stop that becomes a trailing stop a a multiple of the initial risk. By setting this multiple to a large number, I can create the space for some other exit strategy to step in and exit the trade in a way other than that specified by the original Ken Long strategy. I have already identified and coded a second exit based upon the PSAR that I will be testing.

Test results

I have already run over 100 tests with the different systems, using different groups of stocks and assorted options for the strategies. I am generally pleased with what I am seeing, but I will need to dig a little further into the results and do some other calculations within Excel with the trades before I have anything definitive. I still have a lot to learn about the platform, but each day I’m getting more comfortable with the platform and the tools I now have at my disposal to become a better trader.