Reflections

Today was a wonderful example of why I need to automate my trades. While I thought I would be able to monitor the market for the afternoon (not always my favorite thing to do on a Friday), I had a surprise at my job and ended up working much longer than expected. If I can get my cash to work for me, then how long I stay at work would be less important.

As I explore the automation of my trades, I recognize how I have built systems in other areas of my life. Repeated processes are streamlined. Over twenty years ago, someone described my driving as “efficient,” and it’s a word that I’ve found applies in many areas of my life. If there is something I can do to keep from doing the same boring process over and over again, then I take steps to minimize the time I spend on the task. It should be no surprise then that I’m looking to do the same thing for trading. It’s a part of my personality that I need to respect.

Trading requires not just knowledge about the markets, brokers, and platforms, but self-knowledge. This is why buying systems from others does not usually work. Trading systems need to fit the personality of the trader, or there will be constant battles going on between the trader and the system. By recognizing that I am inclined to automate areas of my life, my drive to automate my trades is recognized and becomes easier to implement. Now I just need to settle upon the best software available to me now.

Swing Trades

Six new trades were opened today with the double position in WYNN getting stopped out (-.97R total). I had set a stop and reverse as an intraday play yesterday, but did not keep the stop and reverse overnight.

Currently holding 13 open positions showing a total of +2.44R

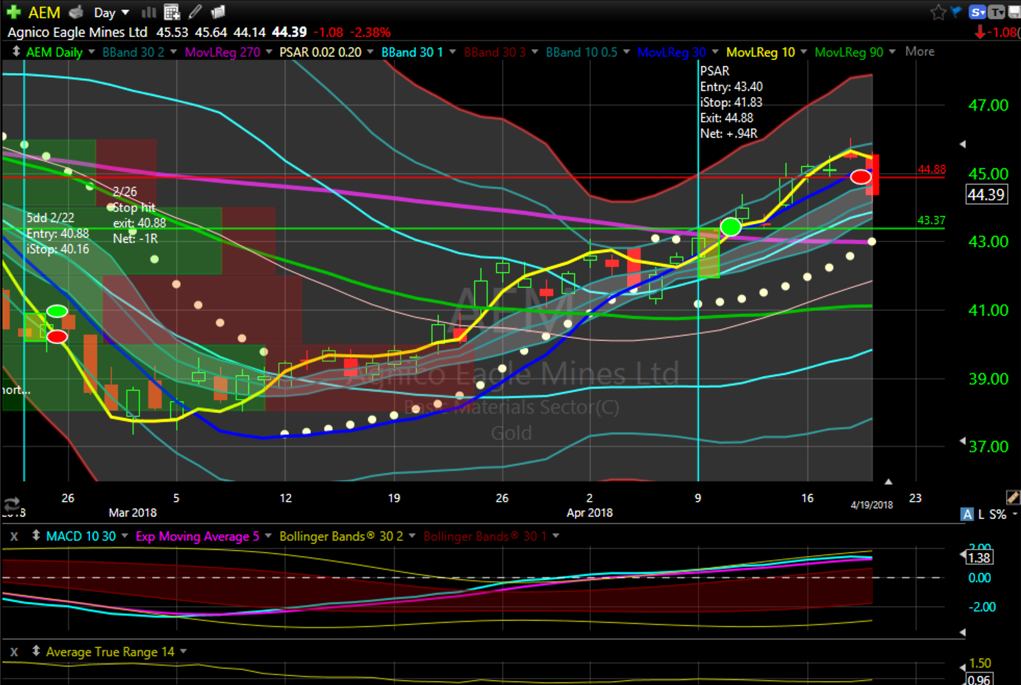

Long: (AEM*) AWK, CAT, CVX, GIS, INTC(2), JPM, MKC, OKTA, TLT.

Short: XES.

*Update from 6/18, I overlooked that AEM also closed out for +.31R.