Reflections

I’m deciding to make a little change in how I write these daily trade reports. The nuts and bolts of what happened will still be reported, but I’m moving those down to the bottom of the post. The journey to becoming a better trade is not a reflection of the trades I take, but what I notice and how I think about the trades I do (or do not) take. If the reflections are the important part, then they should come first.

As you’ll see below, perhaps because I framed no trades this week, the portfolio is down to only two open positions, and one of those barely survived its stop loss on Friday. For that reason, I feel like I will be starting fresh on Monday morning.

The systems I presently trade buy pullbacks in markets trending upwards. Looking at the daily or weekly charts for my favorite targets, very few show strong upward trends at the moment. For the past several weeks, perhaps even 2-3 months, they have been trading in the same range. If there isn’t a 2:1 reward:risk ration available for the trade, I’ll pass on it. Since I started using 2ATR as my position size, that means I need 4ATR of possible movement to the upside before I will enter the trade. In this quieter more sideways movement of the market, that is leaving me with fewer trades to take. My reflections for this weekend leave me wondering if I should go back to a smaller risk amount to frame my trades, or if I just sit on my hands until the market provides me with the opportunities I know.

Swing Trades

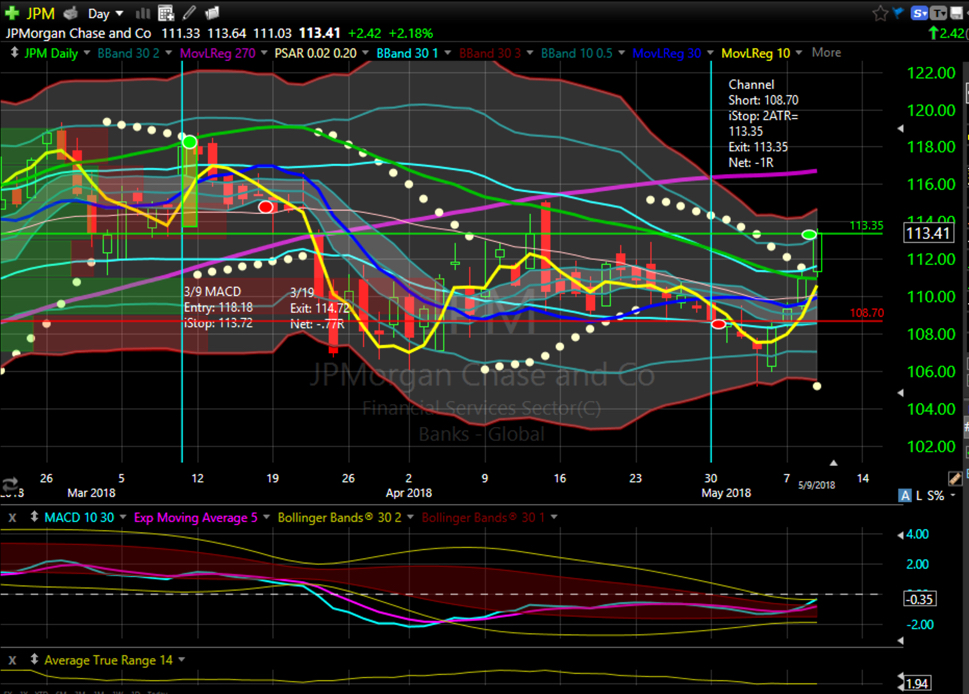

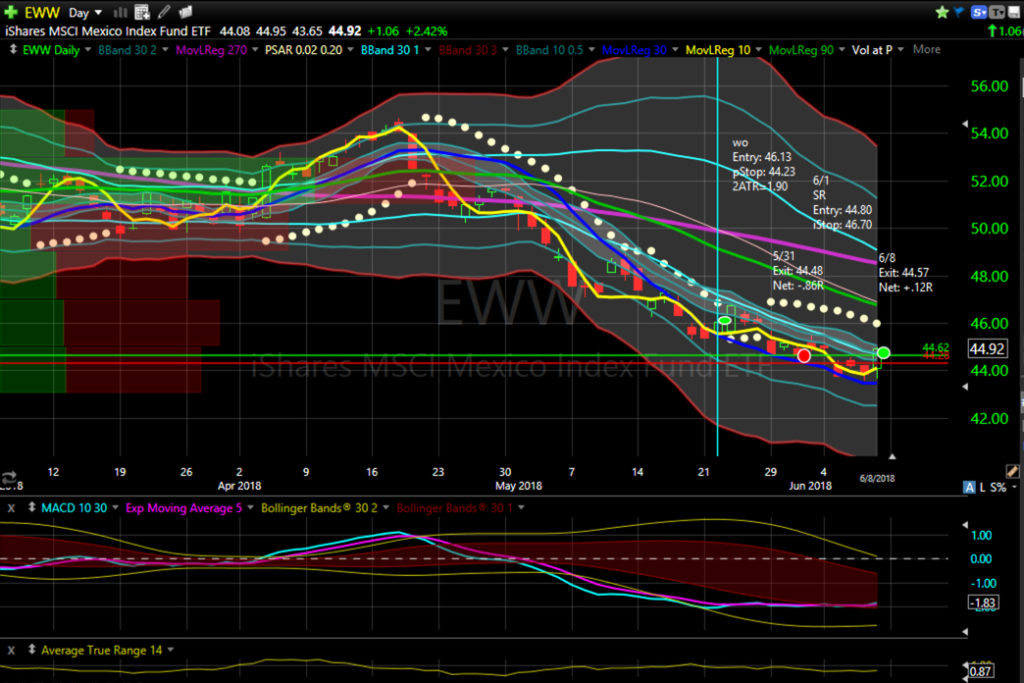

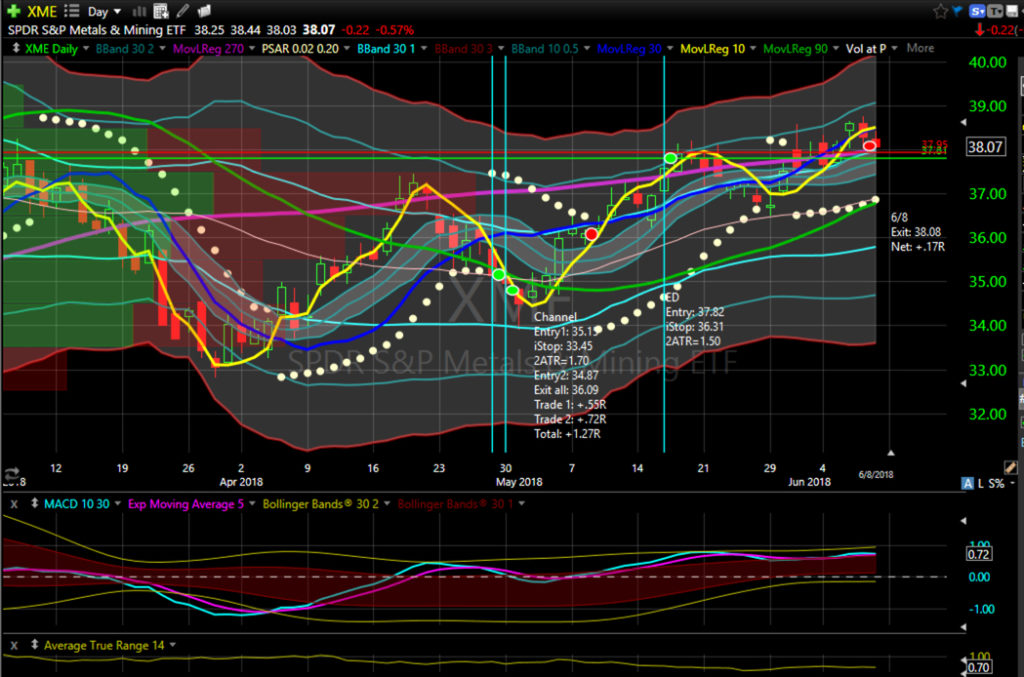

No trades were framed for Friday, 8 June 2018. Six positions were closed: KR, XME, AXP, DWDP, JPM, EWW. Total return for the 6 trades: +3.85R.

Only 2 positionsin the portfolio showing +1.09R.

Long: GILD.

Short: AA.