Swing Trades

Due to some circumstances to be commented upon below, I was not able to make daily posts this week. Below is the summary of swing trades opened and closed for the week.

| Date | 4/30 | 5/1 | 5/2 | 5/3 | 5/4 |

|---|---|---|---|---|---|

| Framed | 4 | 7 | 4 | 0 | 0 |

| Opened | 4 | 7 | 5 | 0 | 0 |

| Closed | 1 | 2 | 0 | 9 | 6 |

| Return | -1.02 | -1.4 | 0 | -2.34 | +1.84 |

Remaining holdings are now:

Long: AEM, BMY, CAT, EQR(1/2), FNV, GLD(2), INTC, KR, PVG, PYPL(2), RIO, TWTR, XME(2).

Short: JPM.

Day Trades

I started well on Monday, but then my classic mistake occurred. Every time that I have blown up, it is because I have held onto a position too long, adding to it instead of exiting or reversing. This feeds into my desire to be right. There is also a touch of revenge trading when I do this in that I am usually looking to fix n earlier mistake, either missing a major move that I had framed properly but exited too soon, or if I get whipped back and forth changing directions because my position size it actually too large.

On Monday, I made a conscious choice to continue past my stopping point (unlike 25 April), and ended up suffering through the night and into the next day until I finally let the position go. This rattled me emotionally, so I basically made an effort to do the minimal amount of work necessary to manage my swing trades over the next few days. If I had been in a better mental state, I could have pared down some of the losses, or maybe even captured a profit, but those are only lessons I have learned after going through this experience.

On Friday, I started day trading again, and did reasonably well for the first two trades. Once again however, I missed a move and built up a massive position that was not moving in my favor. Strangely though, I did not have the same emotional connection to this position. Perhaps it was because I knew it was the paper trading account, but I also believe it was the dots I had connected during the few days off the screen.

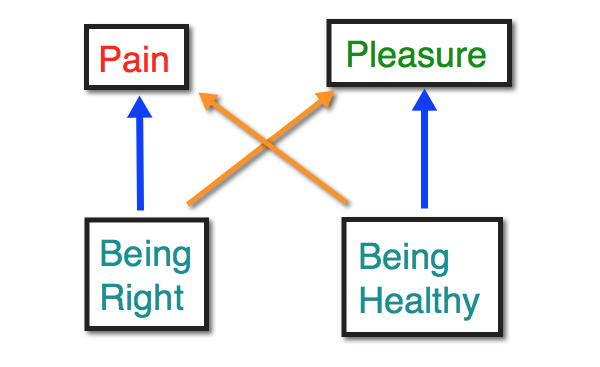

As I mentioned in I am smart, I have a disposition to want to be right. I place too much effort and attachment to having each trade go my way, rather than a more healthy attitude of accepting what the the market gives and trusting my overall results to generate a positive bottom line. Wins and losses are like breathing in and out. They are a necessary activity for healthy living. This week, I believe I took a significant step towards wiring my brain according to the blue arrows in the diagram below as compared to the orange arrows which I believe have created many of my past disasters.

There is the possibility that this behavior will raise it’s ugly head again, but the re-framing and removal of the emotional charge gives me confidence that I can trade in a more healthy manner going forward. While there have been many psychological issues for me to confront on my trading journey (and likely more to encounter), I feel like this is the largest one I have yet to conquer. It set me back this week, but I believe I know more now about it and the feelings it brings on so that should it show up again in the future, I will be better able to act in a healthy and appropriate manner.

I expect to return to daily reports again next week.