Swing Trades

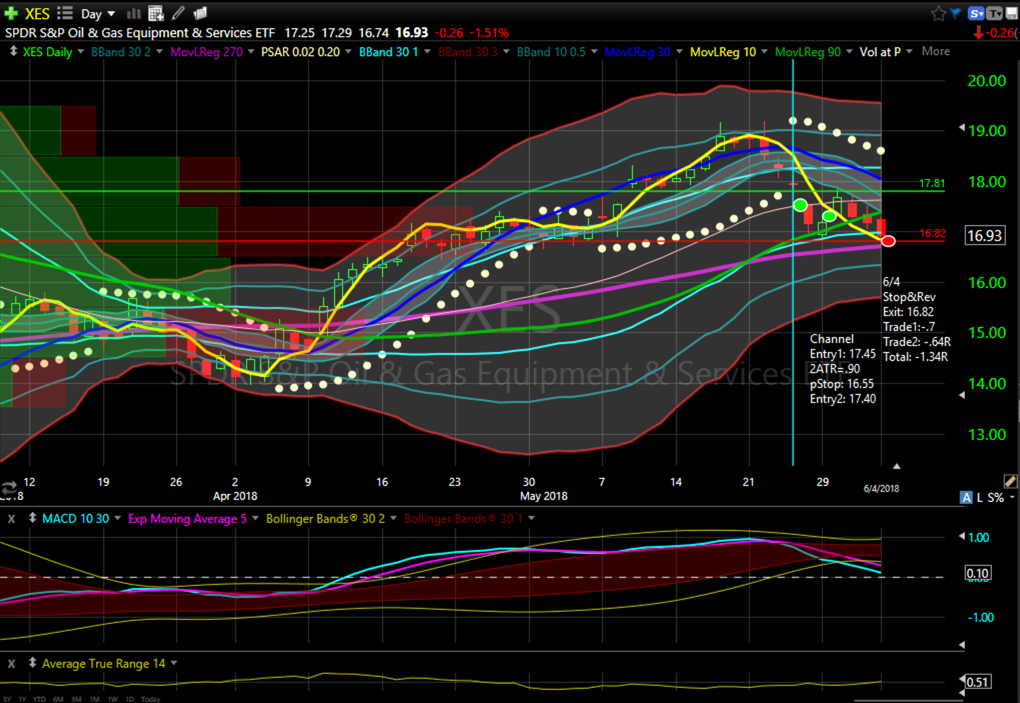

While I performed my market scans this weekend, I was very busy and framed no trades for possible execution today. Two trades (XLE and XES) hit their stop losses, and one of those (XES), I had decided would be a stop and reverse. Total return for the four positions: -.72R

There are now 18 open trades showing +6.95R:

Long: AXP, CRM, CSCO(2), DWDP, GILD, JPM, KR, MSFT, RIO, SLB(2), TWTR, XME.

Short: AA, EWW, IPG, XES.

Reflections

Once again, one of the holdings has moved in after-hour trading. INTC did this after announcing earnings on 26 April. Earnings is something we can generally anticipate. Sometimes a stock starts to move before the news becomes public. This is why I generally watch the chart instead of spending my time trying to stay current on all the details about each specific company and its operations. I only make or lose money when the price moves, so the price is the primary piece of information that interests me.

Tonight as I went through the portfolio to update stops, I had moved the stop for TWTR based on the most recent trade price, but when I went to look at the chart, I noticed the official close was below where I just put my stop! A quick search of on-line news sources showed that TWTR is scheduled to join the S&P 500 this Thursday as Monsanto (MON) completes the merger with Bayer AG. I had noticed that TWTR showed strength during recent market weakness, which is one of the reasons that led me to add it to the portfolio. I’ll be very interested to see how it reacts over the next few days as the change in the index is implemented.

I’ll be drafting a few more trading belief posts later this week as I’ve identified a couple of key points that must be mastered to succeed in virtually any endeavor.