Swing Trades

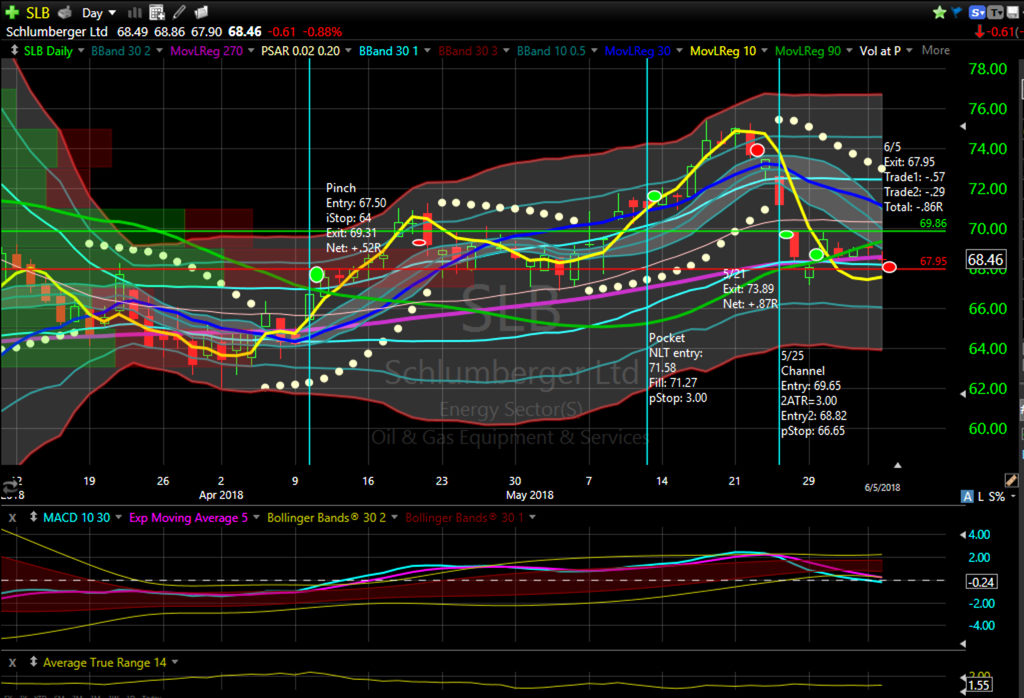

I framed no trades for possible entry today. One position hit it’s stop loss: SLB. With the weakness in the oil sector and other trades reaching their stop losses recently, I tightened up the stops on the remaining stocks in the same sector, and SLB closed today because of that. Total return for the double position: -.86R

There are now 16 open trades showing +8.88R:

Long: AXP, CRM, CSCO(2), DWDP, GILD, JPM, KR, MSFT, RIO, TWTR, XME.

Short: AA, EWW, IPG, XES.

Reflections

The trading signals I have been focused on recently buy pullbacks. When the market moves up strongly, it leaves few candidates for possible trades. While I’m sure there were opportunities in the market these past two days, none caught my eye sufficiently to frame up and trade. Today’s doji in the market (smaller range and close near the open), suggests to me that there are other people generally satisfied with their current portfolio. I could make a case for further strength and for further weakness. Tonight I will prepare a list of targets for trades, but I have no predisposition for which way the market will go tomorrow. I do have time to sit and watch the market, so am preparing to pounce on what decides to move tomorrow.