Swing Trades

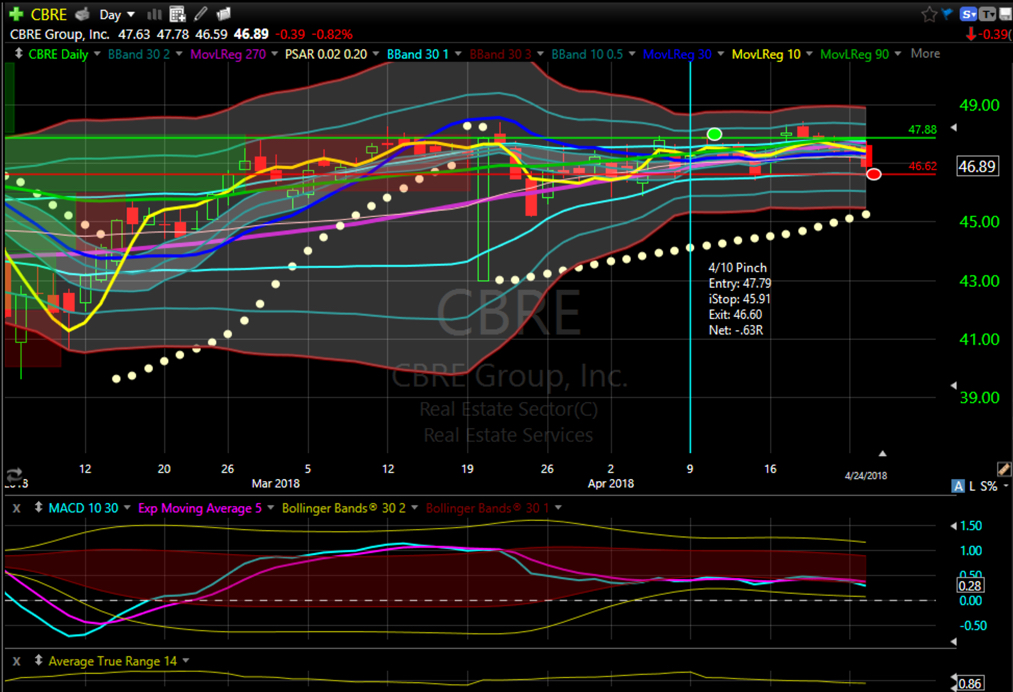

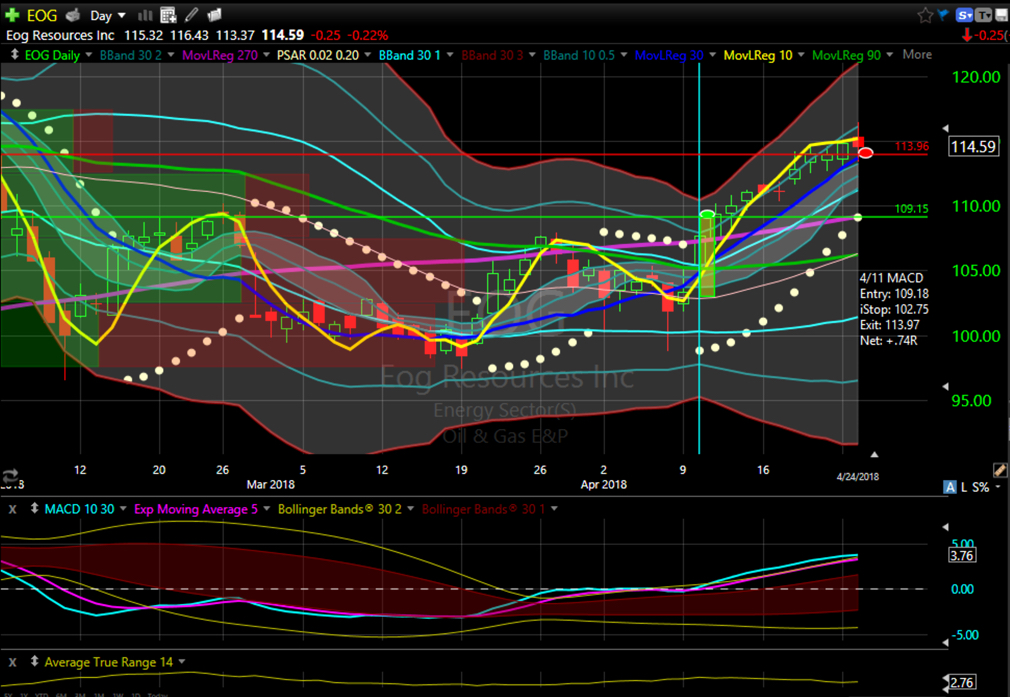

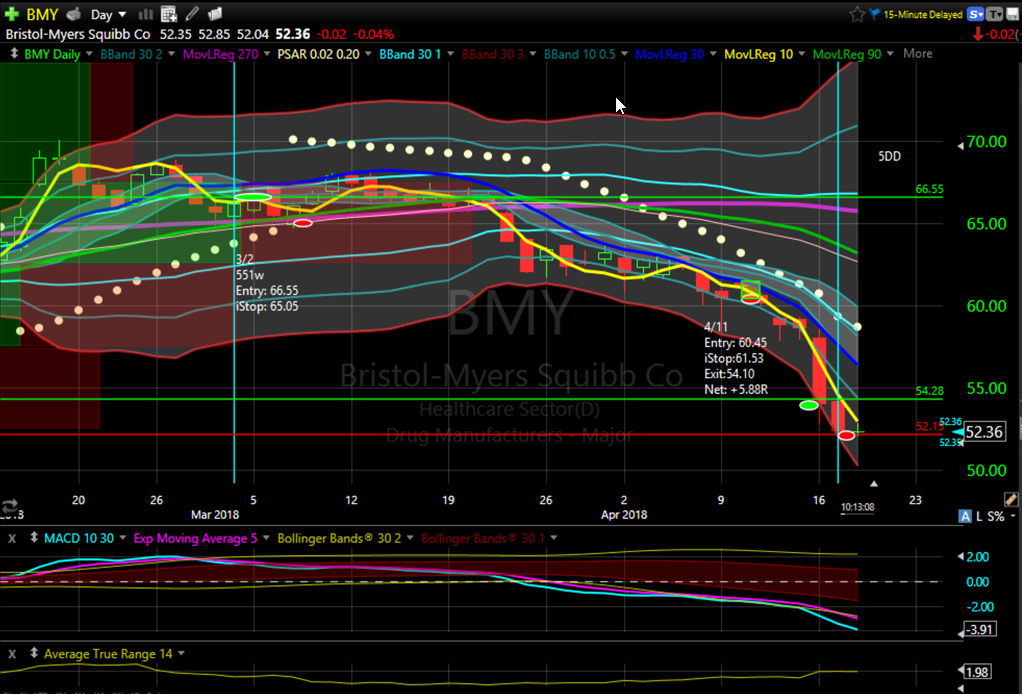

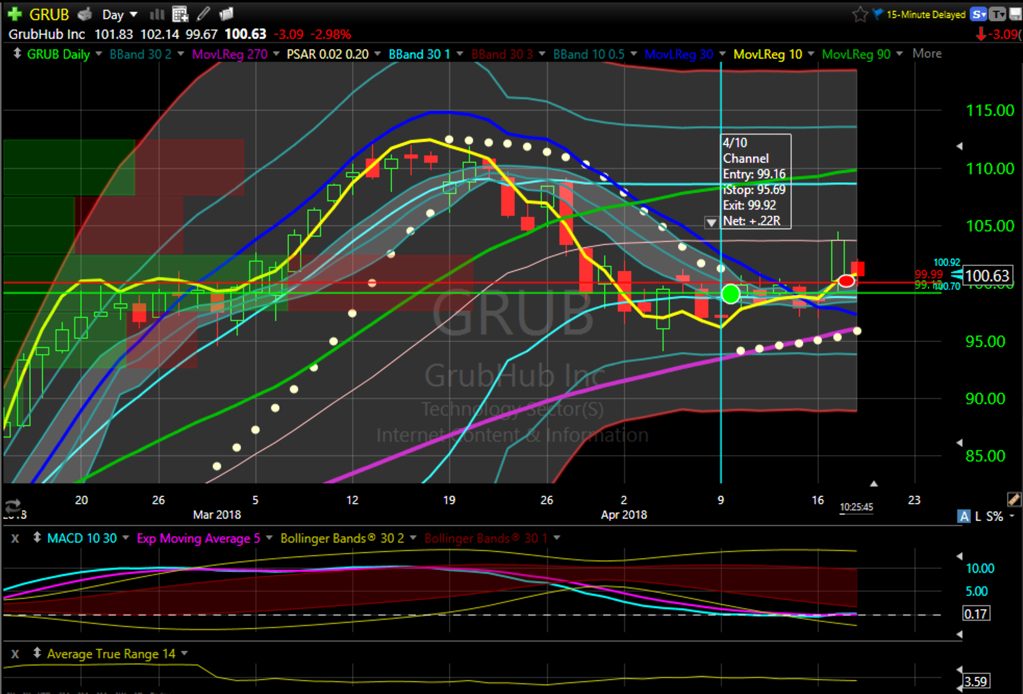

I framed no trades for possible execution today. Eight positions hit their stops: FNV, EQR, USO PVG, BMY, MRK, XME(2).

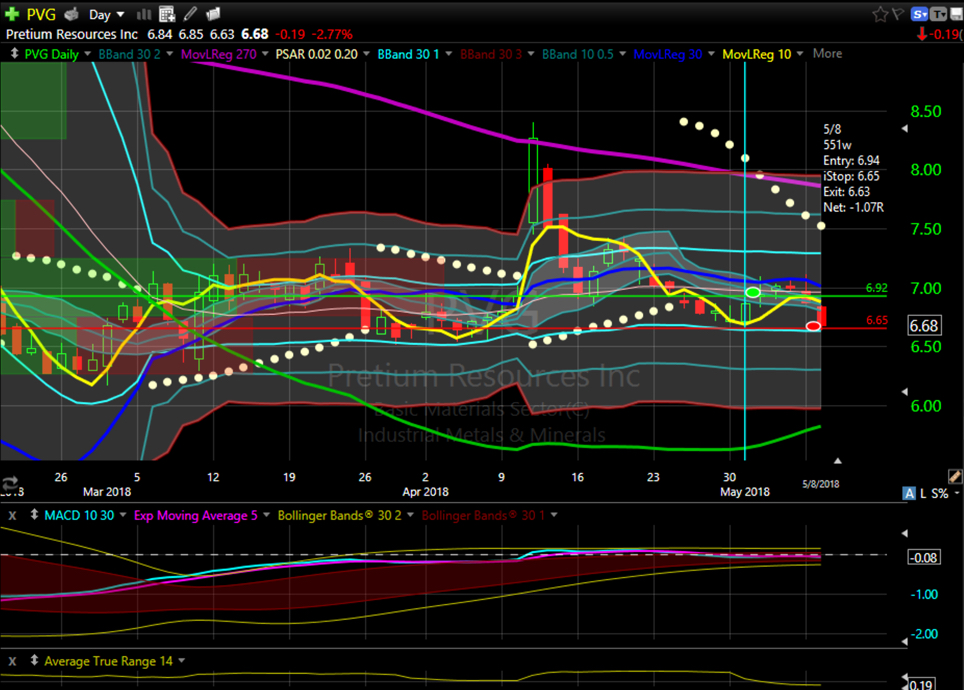

Knowing XME was to be closed today and seeing gold down at the open, I probably could have cut PVG earlier in the day:

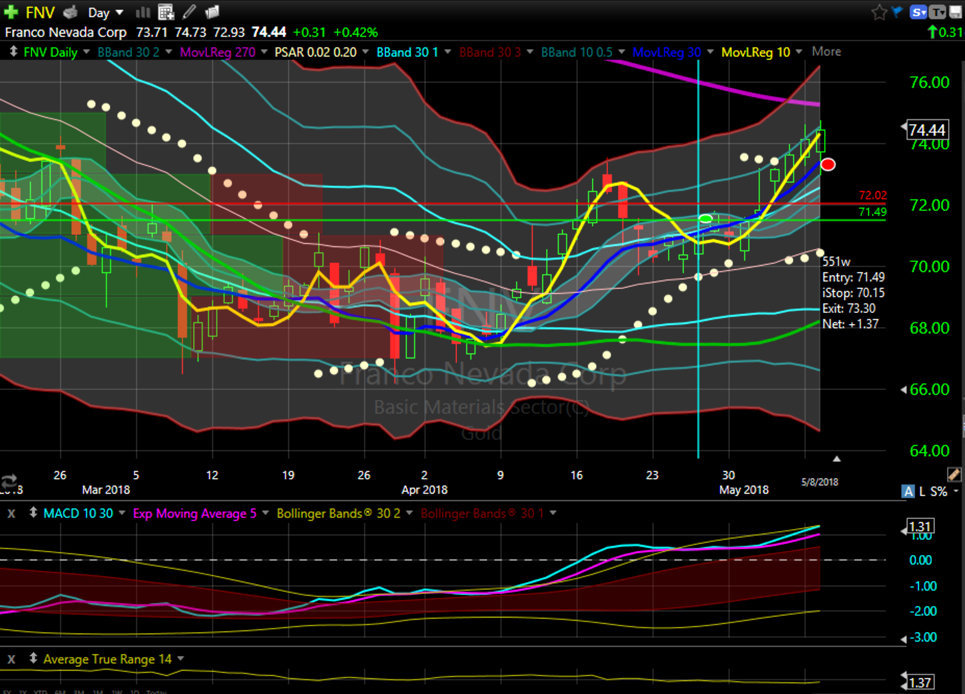

XME had met the criteria to be closed at the end of yesterday, but I missed closing it. I tightened up the stop on FNV and got cut out on the second test of the bottom for the day.

Moved the stop up and exited the second half of EQR today on general market weakness:

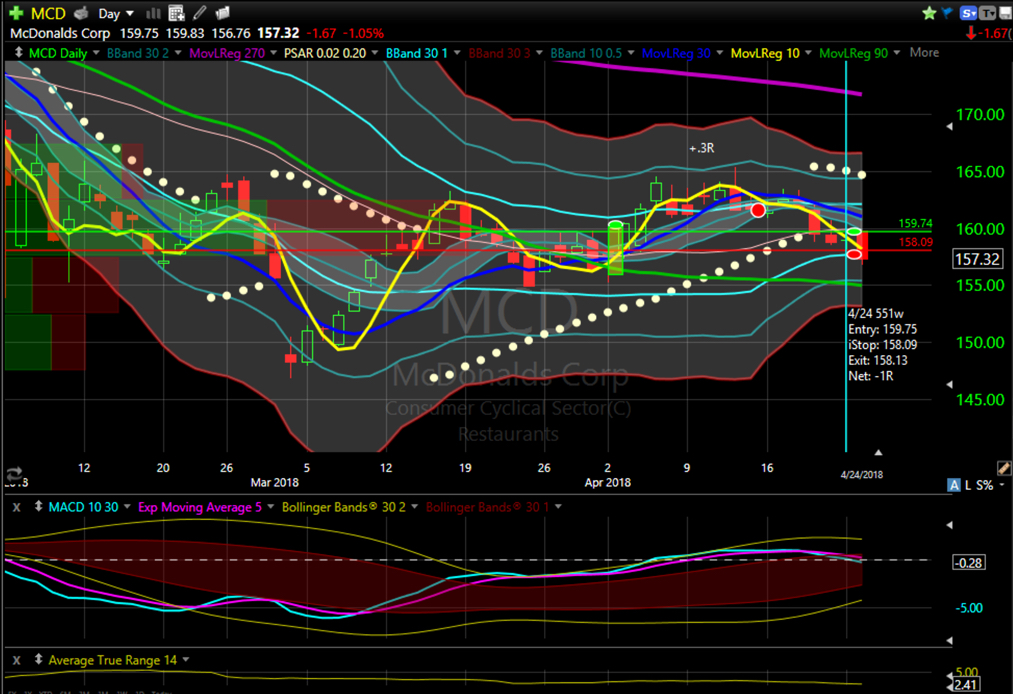

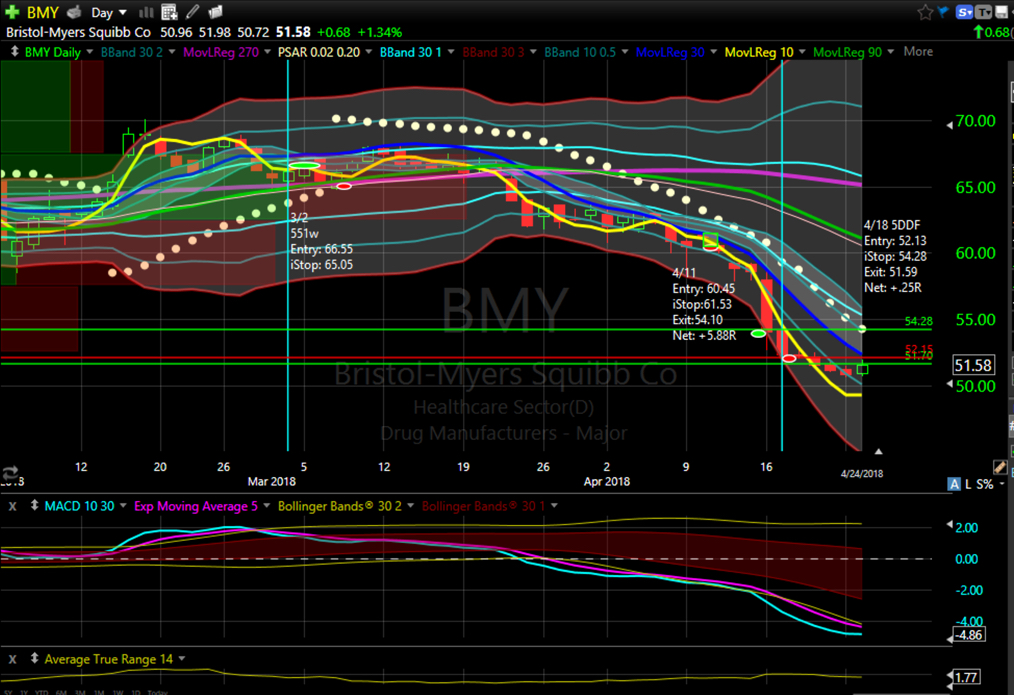

Could have cut BMY after the PSAR flipped, but I was willing to be patient for the huge upside back to the RL270. In a market with no clear direction though, it’s better not to hold on to the weak candidates.

Was playing MRK for a bounce off the Bollinger band mean, but all it seemed to do after I entered was go down.

I had entered the stop as a trailing stop instead of a hard stop on USO, so got taken out on the spike down today. Not what I was expecting for a 2ATR stop from my entry point just a day after entry, but oil can be volatile.

Total restults for today’s closed trades: +.61R (but that includes the full value of the EQR trade. Without it, -.4R.) There are 15 current open positions showing +2.39R.

Long: AEM, BMY, CAT, GLD, INTC, IR, KR, OXY, PFE, PYPL, RIO, TPR, TWTR.

Short: JPM.

Day Trades

I had no time today to sit and watch the market, so I was not able to make any day trades. I may be able to catch the last hour of the market tomorrow, but from the looks of my schedule this week, I don’t believe I will be able to place any more day trades this week. Perhaps I will load up the replay in a simulator to keep my game in shape as I do have some time outside of regular trading hours that I can devote to trading.

Reflections

The market seems indecisive. For yesterday and today, the major indexes closed very close to where they opened. With no clear direction from the market, it’s hard for individual stocks to move very far. My general observation is that when the market moves into a sideways quiet channel, I get chopped up and take losses looking for directional moves, whether continuations or reversals. These periods create my drawdowns. I’m still taking the trades as paper trades so that I can track where my equity turns around and learn more about what to look for when I will be trading real money. I want documented proof to back up my intuition of what happens to the systems I currently trade.