Swing Trades

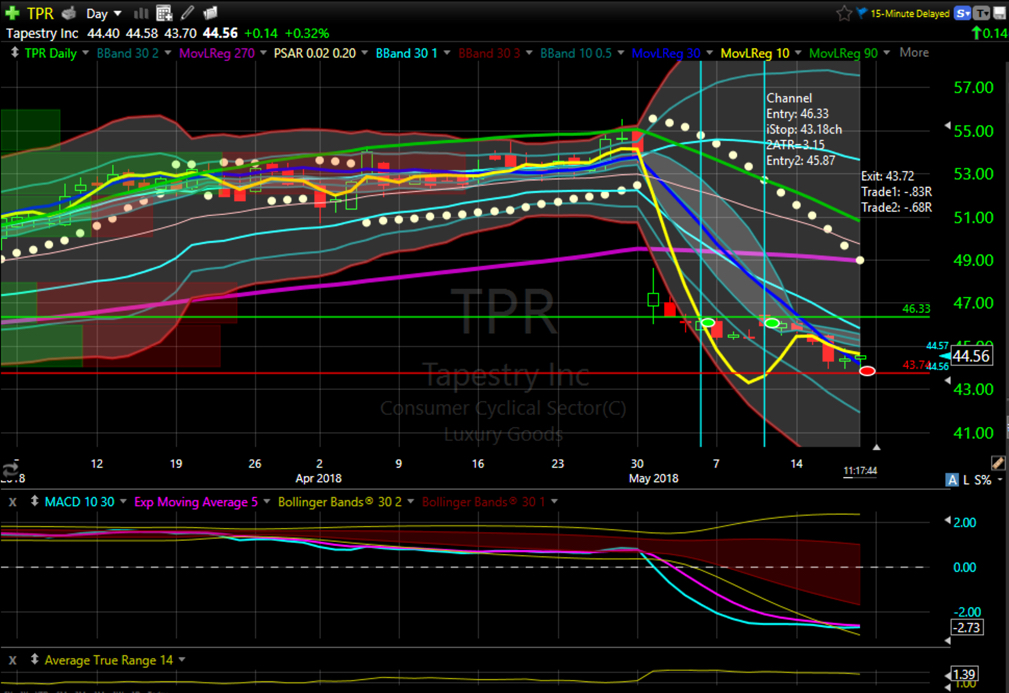

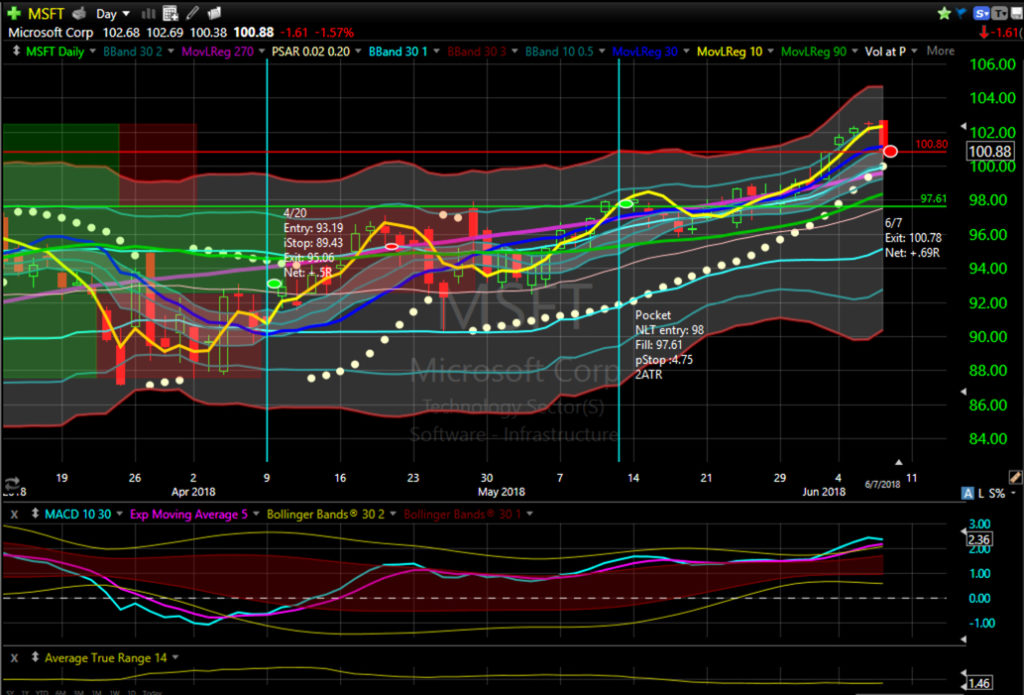

No swing trades were opened or closed for 6 June 2018, so there was no trade report yesterday. No trades were opened today, but 8 trades were closed: MSFT, CSCO(2), CRM, RIO, TWTR, IPG, and XES. Total return for the 8 positions: +5.16R

This leaves the portfolio reduced to 8 positions, currently showing +5.38R

Long: AXP, DWDP, GILD, JPM, KR, XME.

Short: AA, EWW.

Reflections

While the market indexes are showing strength, I feel like it is not broad strength. Select companies are doing well, and others seem to simply be hanging on. Either I’m looking at more stocks that are under-performing, or I need to broaden my watch list.

I’m still working on some other extended posts with reflections on my insights and thoughts from this week. Somethings have gone well. Others not so well. The saying goes that if you ask better questions, you get better answers. I also believe if you ask frequent questions, even if it’s the same question, you may get different answers. Reporting my results here forces me to ask the same questions over and over again, and by doing this, I feel like I’m coming up with better answers, or at least a better sense of what I am doing in the market. Most importantly, I’m starting to see some of the ways that my personality and beliefs trigger my behaviors in the market.

There is a confidence that comes from positive trade results, but there is also confidence that comes from doing the same tasks every day. Trading is a complicated system, just like an automobile. I’m looking to get my trading to the point where it works just as reliably to generate income as the car works to get me from place to place. While you can certainly purchase trading systems like you buy a car, the market continues to change, so with a trading system you bought, you will never know when it needs maintenance or is broken beyond repair.

Think of how much knowledge has to go into building a car. Even a gifted auto mechanic is unlikely to know how to actually make the glass for the windshield or the steel for the engine. I will likely never know all the intricacies of how an order I place to buy or sell stock gets from my computer to the exchange for execution, but I need that process to be just as reliable as my car. If it breaks, I either need to know how to fix it, or how to have the problem fixed for me.

Trading requires not just the mastery of an auto mechanic, but also the skills of a professional driver. Great returns demand great skills. While it may not be safe to go slowly on all the roads all the time, it certainly doesn’t require as much driving skill as racing around a test track at 200 mph. I’m looking for market trouncing returns, so I have to keep working on my trading until I am at the same level as the professional race car driver.