Swing Trades

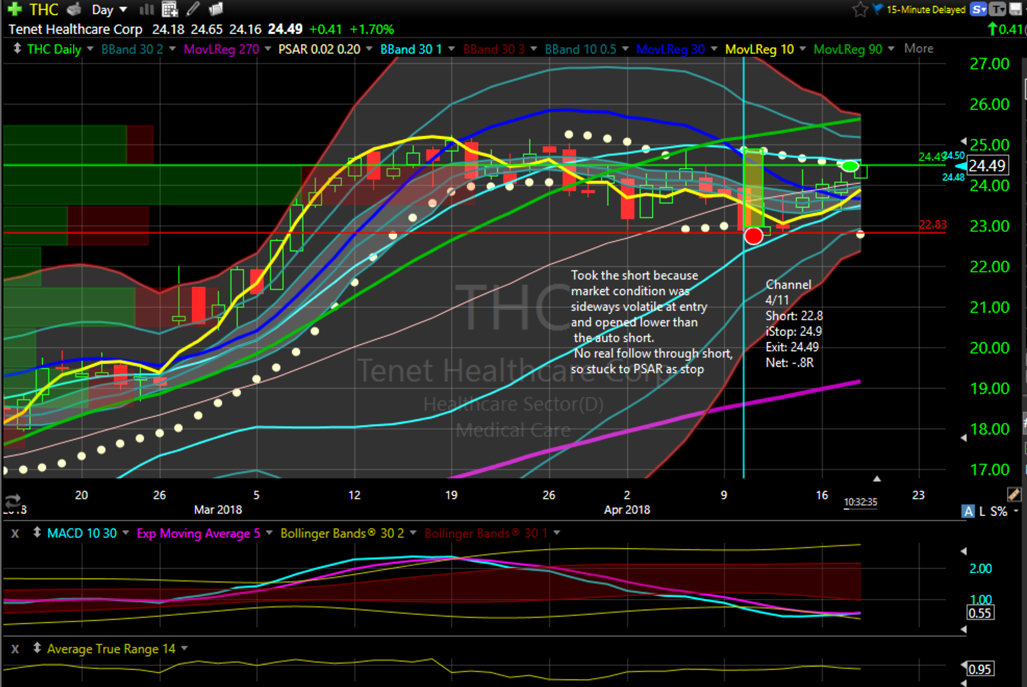

Today I framed four swing trade candidates. Because three were channel signals to buy at the open, those three fired. The fourth one never reached the target entry point.

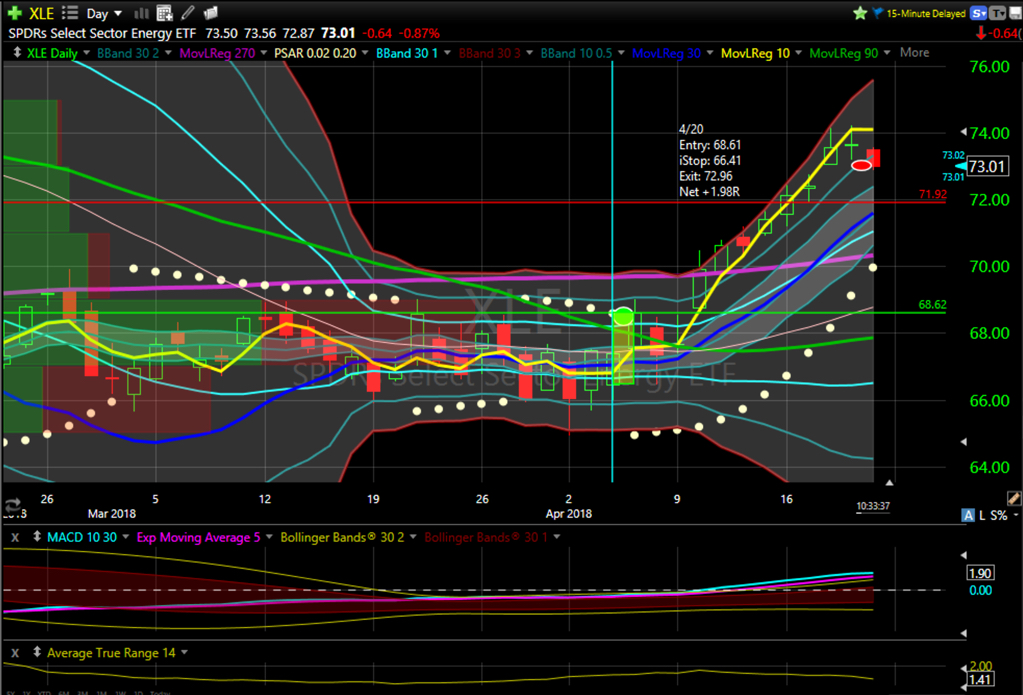

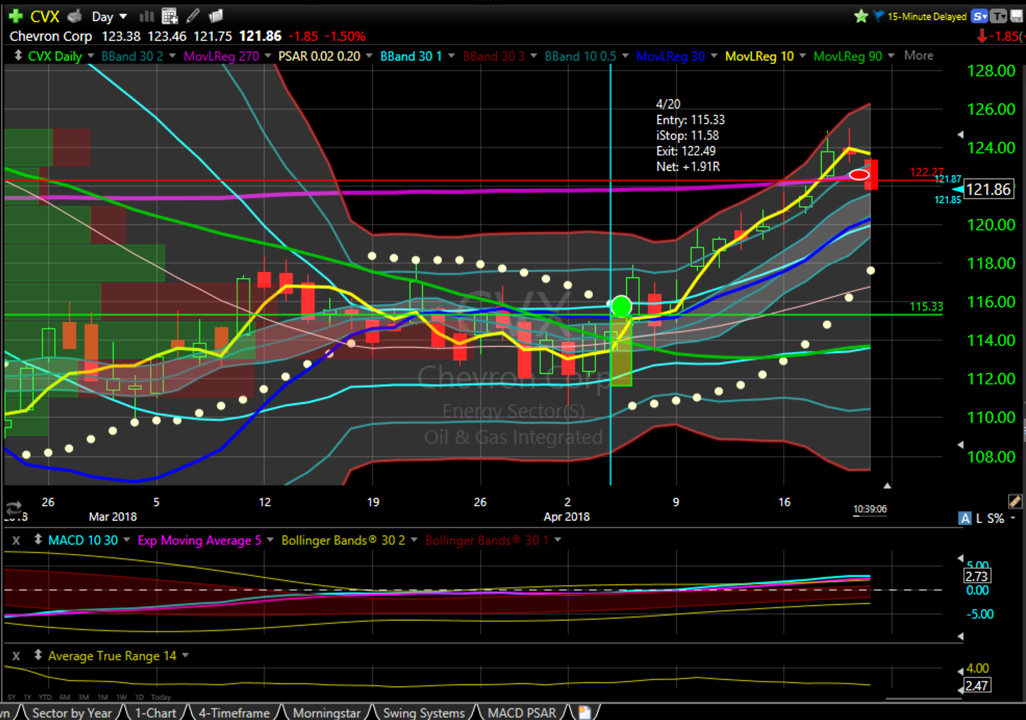

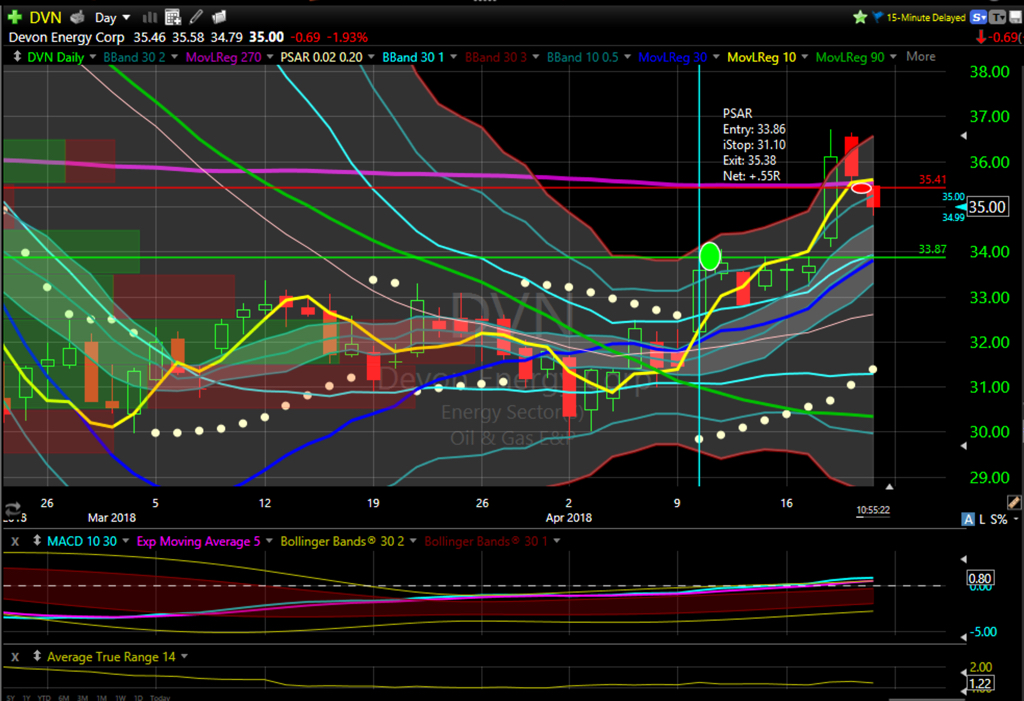

Ten positions closed today for a total realized gain of +9.3R. Charts follow below. After a few of the oil sector plays hit their stops, I moved the stops up for the others. Continued weakness took those out, but EOG seems to have survived the day.

Currently holding 13 open positions at +4R.

Long: ABX, CBRE, GLD, EOG, LMT, LRCX, NKE, RL.

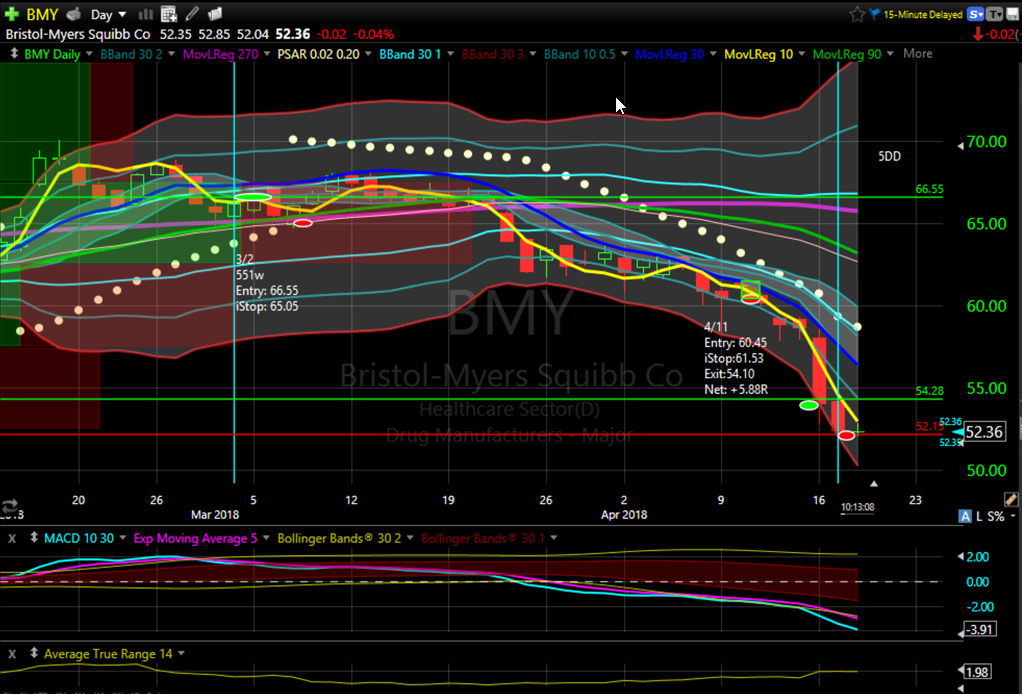

Short: HSY, NYT, BMY, MRCY, XLP.

Day Trades

Friday is the one day currently I can generally expect to have available to day trade. I missed some of the large moves while managing the swing portfolio, but that’s ok. I’m not expecting to capture every move, nor do I need to. I ended up making 24 day trades with a net +3.8R.

Thoughts

I am currently reading Market Mind Games by Denise Shull. While the book tries to present the information in the more digestible setting of a fable, the information is dense and requires some thought and time for integration. I had two a-ha moments while reading this morning before the market opened. the first had to do with fighting trends which I certainly did today, and for which I intend to write a separate post. The second is best shared by quoting directly from the book:

Now I am certain that part of the irresistible seduction of markets is not the money but the tapping into an innate human urge, desire, or force to grow. It strikes at the core of competitive and adaptive instincts and serves up for the taking any unconscious psychological set-ups one has.

Your pschye doesn’t actually care much about your account balance, it cares about your emotional capital because it is your most important asset regardless of whether you are in front of the screen or not.

I am certainly hooked on learning and growing, and if there is any reason I have stuck with trading for as long as I have it is because I recognize that slowly but surely, it is helping me to confront my issues and become a better person. Trading is a psychological discipline that requires a certain amount of knowledge, but depends extensively on the amount of presence and awareness one can bring to the market. Not just awareness of the market, but also self-awareness. Anger, frustration, joy, or even the weather can affect a person’s view of the market and thus influence the account balance.

As I continue to make these trade journal entries, I expect to also start adding notes about my mental states and feelings. As I reported on 18 April, having decent overall results while aware of not so great emotions is to be celebrated. Which are the emotions that I can trade with, and which ones are strong enough that my account balance will be better served by not trading?