Swing Trades

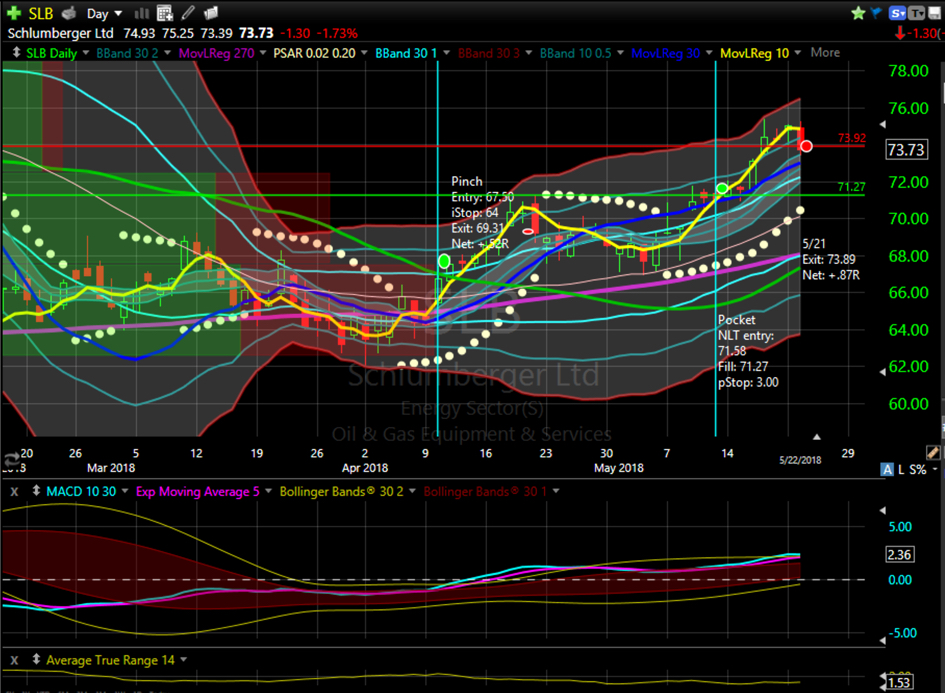

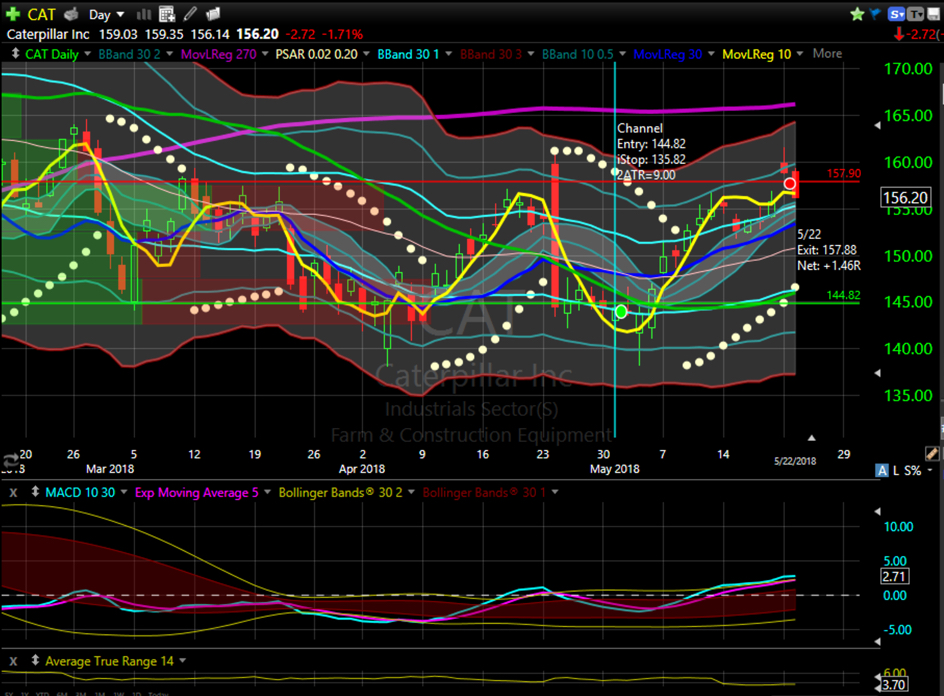

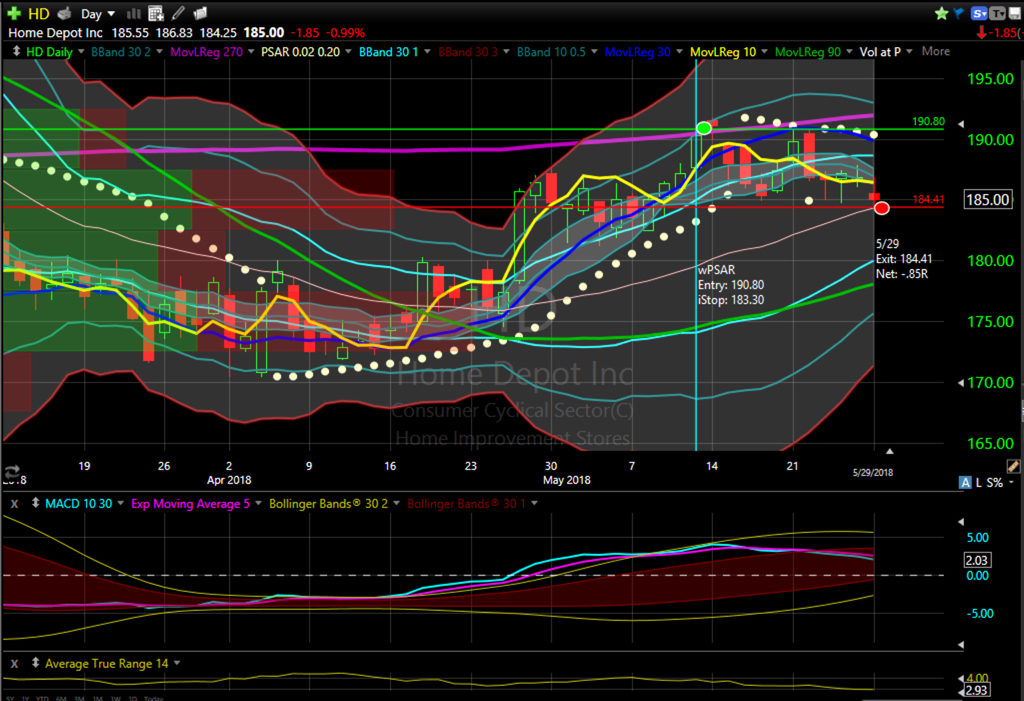

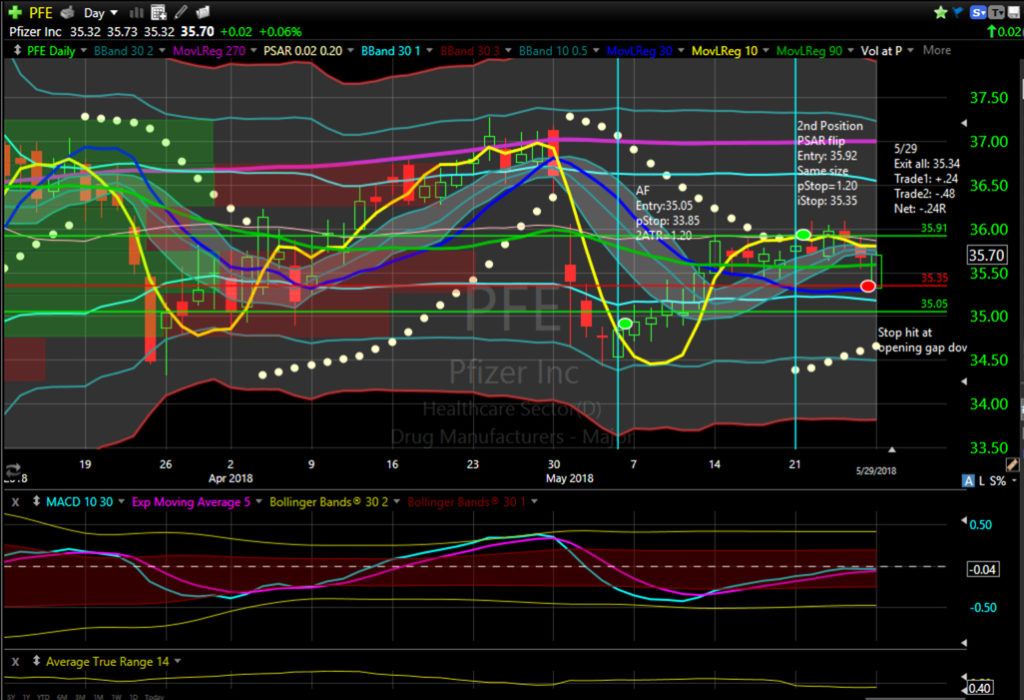

With the Memorial Day holiday and a busy schedule, I have not been consistent at monitoring the market or framing trades. I quickly framed three channel trades as the market was opening last Friday, 25 May 2018. They would have triggered second positions on Tuesday, but I did not frame any trades during the holiday weekend. I was able to frame 9 trades for execution today and received fills on all of them. Three trades were closed on Tuesday as the market opened lower. PFE opened below the stop, so even though it moved up while almost everything else moved down, I was out at the open. HD also hit its stop loss.

Net return on the closed positions: -1.09R

With the 9 positions opened today, there are now 21 open trades showing +3.54R:

Long: AXP, CRM, CSCO(2), DWDP, EWW, GILD, JPM, KR, MSFT, RIO, SLB(2), TWTR, WYNN(2), XES(2), XLE(2), XME.

Short: none.

Reflections

From my market screens, I recognized a general oversold condition last evening. While I expected today to be an up day, I also knew that there could be a gap up, so I placed a trade in the futures overnight. There was a gap up, so I closed out the trade without waiting to see what the market actually did today. Given my inconsistency for the past week, I am delighted to have captured what I did. This week is a chance to get back into the routine.

April contained a large drawdown in my return. (There was also a decent recovery.) May has been more stable and generally upward, though I haven’t collected the larger returns from the beginning of the year. I also adjusted my position sizing after the drawdown in April, so in this calmer market, with wider stops, it simply isn’t possible to generate as many R. I need to find out what my maximum negative excursion is on each of these trades to see what insights I can gain on using tighter stops. If I can cut the distance to my stop in half, then for the same dollar price move in the stock, I would collect twice as much return. When I started this year, I know I was using much tighter stops than the 2ATR that I am presently using for almost everything. Using a .25ATR stop in a market with increasing volatility led to some stellar trades that simply will not happen in this quieter, less volatile market.

Part of trading is knowing when to press your advantage and when to hold back or stay out of the market. Last night I recognized one of my edges and pushed the pedal down. I may have let up too soon, but at least this time, I put my foot on the gas. Knowing how tight to place my stops will give me better control of the gas pedal. Large stops for cautious times, and tighter stops when it’s time to put the foot down and go.