Swing Trades

I framed only one trade for possible execution today: adding a second position to PFE. It was filled shortly after the open. I have had several other projects taking the majority of my time the past few days, so I had no other trades to consider. PFE was framed because it is a current holding and looked ripe for a possible second position.

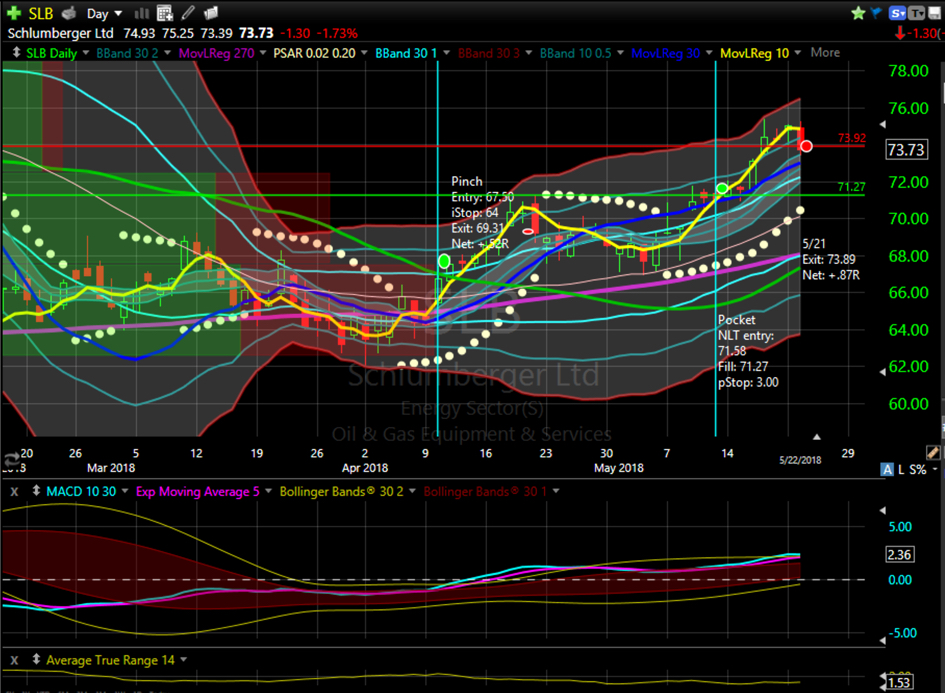

Two trades hit their stop losses today: CAT and SLB. Net return for the two trades: +2.33R.

This leaves the swing portfolio with 17 positions showing +.8R.

Long: AA(2), CBOE, CSCO, DIS, EWI(2), GILD, HD, IR, KR, MSFT, PFE(2), WYNN(2), XME.

Short: none.

Reflections

I have had no time to day trade this week. I expect to get a few peeks at what is going on during the next two days while the market is open, but will need to rely upon my stops to lock in profits and minimize losses. The market classification system I am currently studying encourages a cautious approach at this time, so I may have missed my opportunity to lock in profits on some of the positions today as they went against me.