Swing Trades

Today, I closed nine and a half swing trade positions. Some hit their stop loss. Some (including the half) were strikes to bank some profits.

First up is INTC. While I was writing my report Thursday evening, I noticed there was a major move up. Intel had reported earnings after the close. Since I had two positions on, I chose to exit one then and there. As you can see from the chart, the fill was well outside any reasonable range of normal. I kept the other position open on the chance that it might be a “gap and go” sort of move. Once it became clear that it was moving down from the opening gap, I closed the other half.

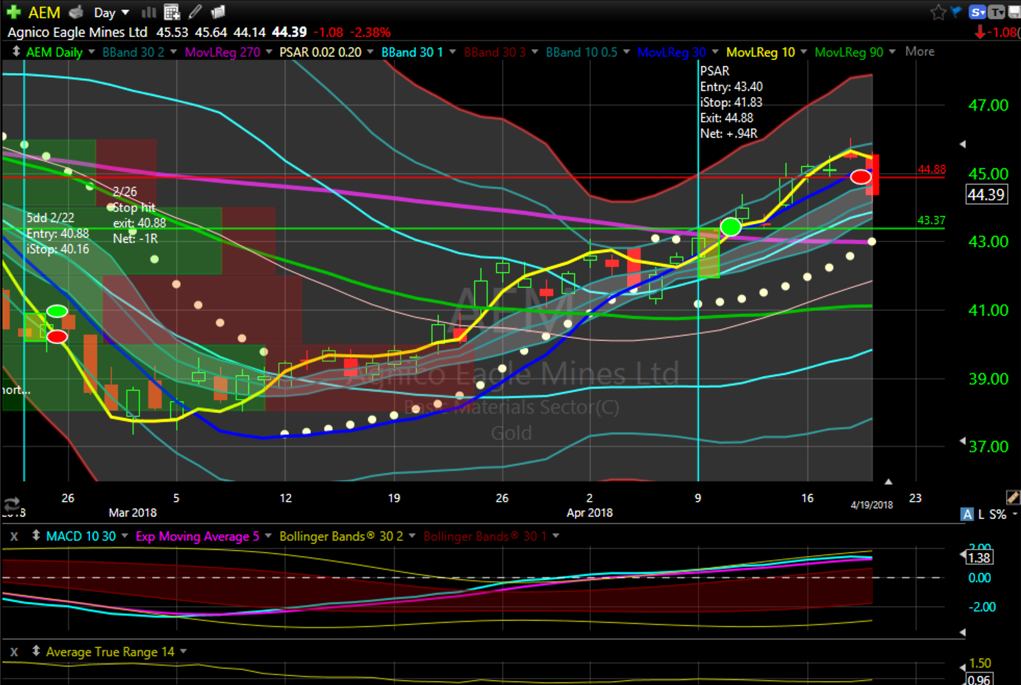

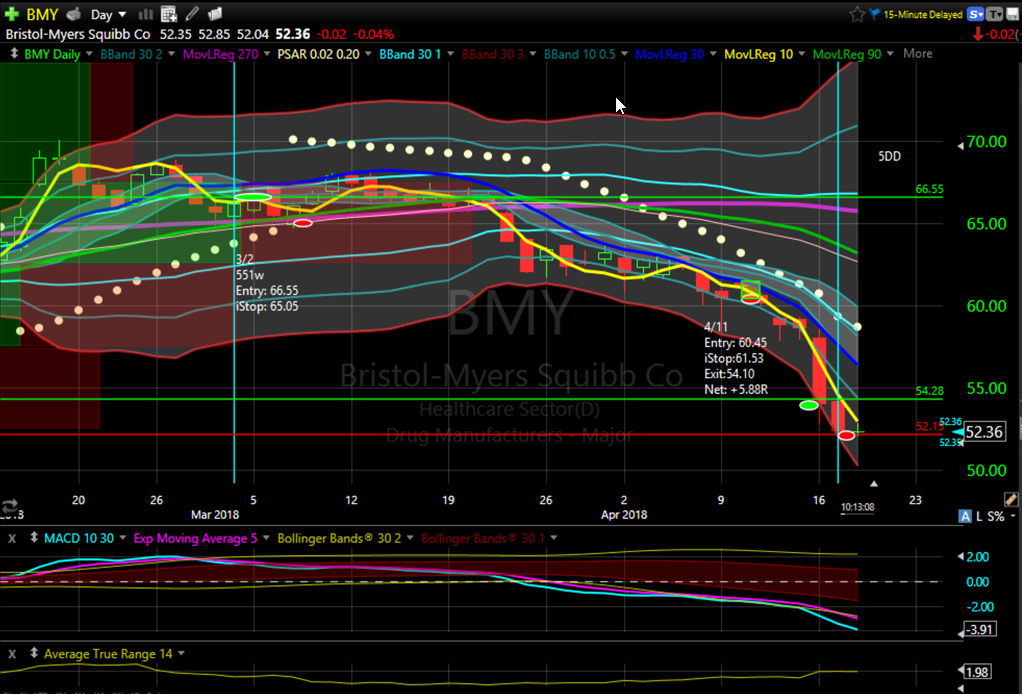

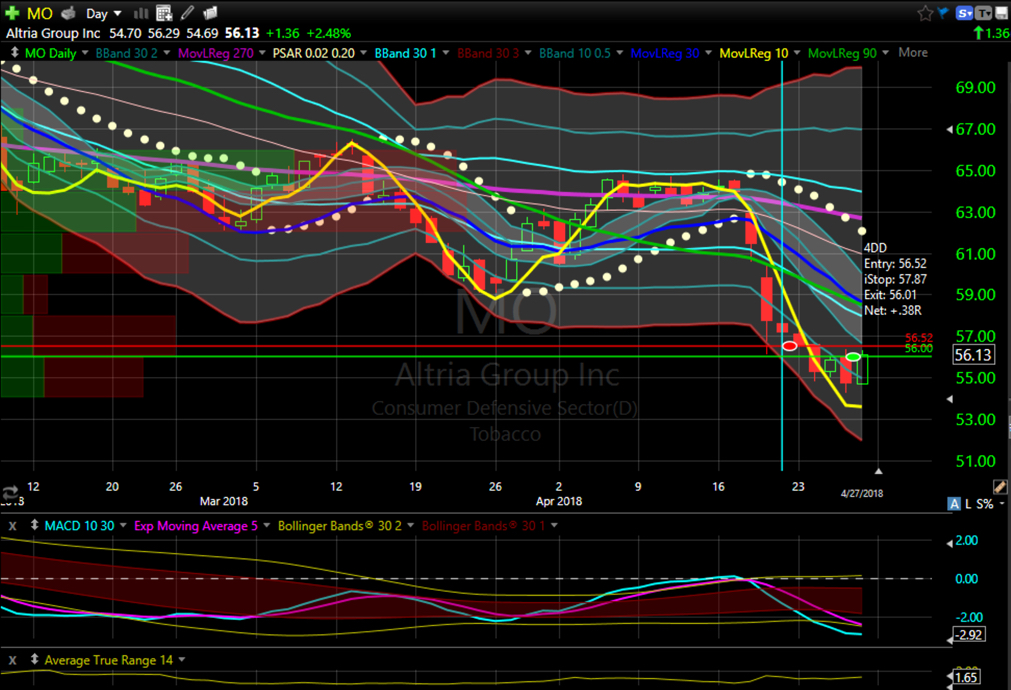

AEM, TSLA, and MO all hit their stop losses.

The next exits were more discretionary. The NYT short has been open 10 days, and while it is at the lower end of the range, I feel like it is money that might be better used in another trade. I also was not a fan of the fact that the stock only trades in .05 increments. Because of this, it will no longer be one of the targets on my radar.

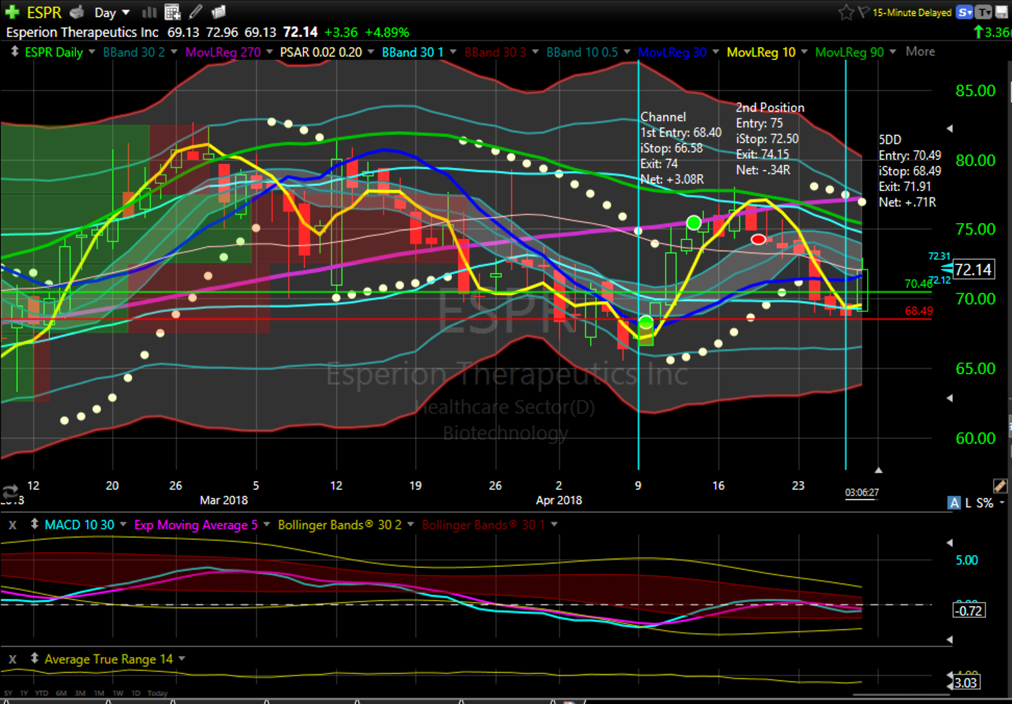

The other trade that was both opened and closed today that will be removed from my radar screens is ESPR. It made it to +1R today, but the bid-ask spread was so wide that I couldn’t get a fill on my limit order. I finally got a fill for an exit at +.71R.

The long position in O moved +1R in my favor today. It touched the upper bollinger band, so while there might be more left on the upside, it felt wiser to take the money off the table.

EQR also moved more than 1R in my favor today. Rather than exit the entire position, I chose to exit half. EQR seems more bullish to me that O, so I’m waiting to see what happens next here.

I think that just leaves RL as the final trade I closed today. With two positions on and some indecisive back and forth sorts of move, I felt better reducing exposure here.

Five swing trades were framed for possible starts today, and four of them filled. As mentioned above, I closed out ESPR already. Net results for all closed trades today: +4.93R plus the half of EQR (+1R). There are 19 current open positions showing +3.44R.

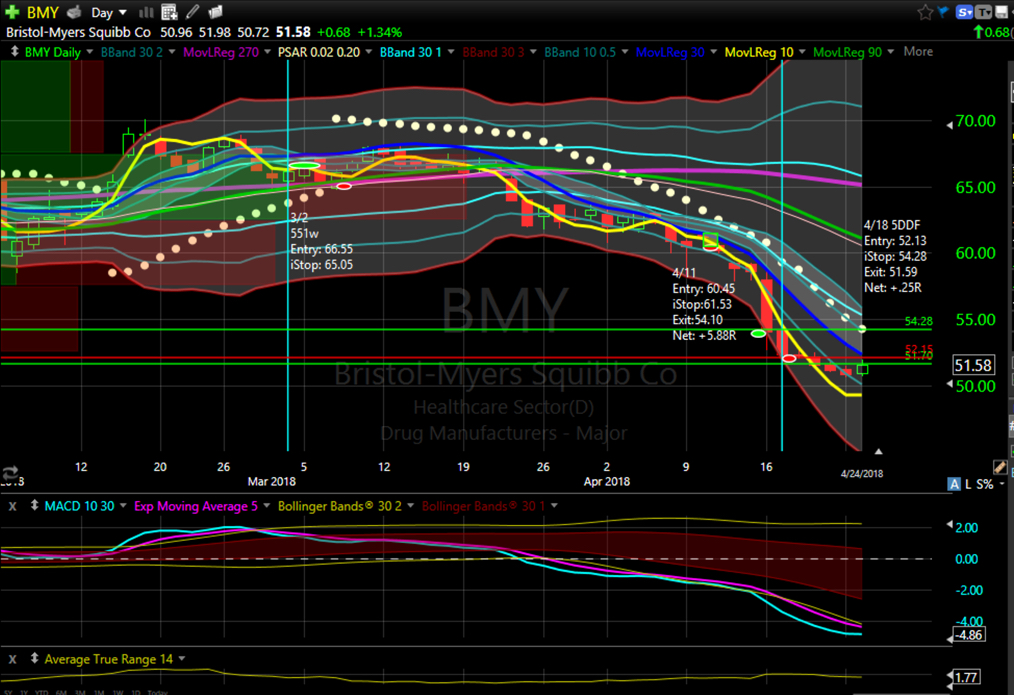

Long: AA(2), AAPL, BMY, EEM(2), EQR(1/2), EWG, FNV, GLD, ILF(2), KR, LRCX(2), RL, WPM, XLF.

Short: PG.

Day Trades

I was much more selective in my day trade entries today and only took 9 trades in the morning. Friday afternoon can be a slow grind or have crazy swings, so I chose to stay out after lunch. The nine trades generated +2.5R and had only one small loser. This is definitely a step in the right direction. Be more patient and more picky about when to enter and make sure there is a reasonable reward target available for the risk. Current commission costs are such that I pay 1R for every 25 trades. Keeping my number of trades down will reduce my commission costs and increase what I get to keep.

Thoughts

All the trades I chose to close arbitrarily today were winners. What about the positions showing losses? Would there have been benefit to reducing my exposure there instead or as well? What about the saying to cut your losses short and let your winners run? I closed out the winners, not the losers today. Was that wise?