Starting first with the trade report for 21 May 2018. I framed no trades for possible entry today, though two positions did hit their stop losses: SKT and STZ.

Both initially moved in my favor, so I moved the stop closer to the entry, but they eventually moved against me, so were closed out today for losses. Total result for the two trades: -.86R

This leaves the swing portfolio with 18 positions showing +4.69R.

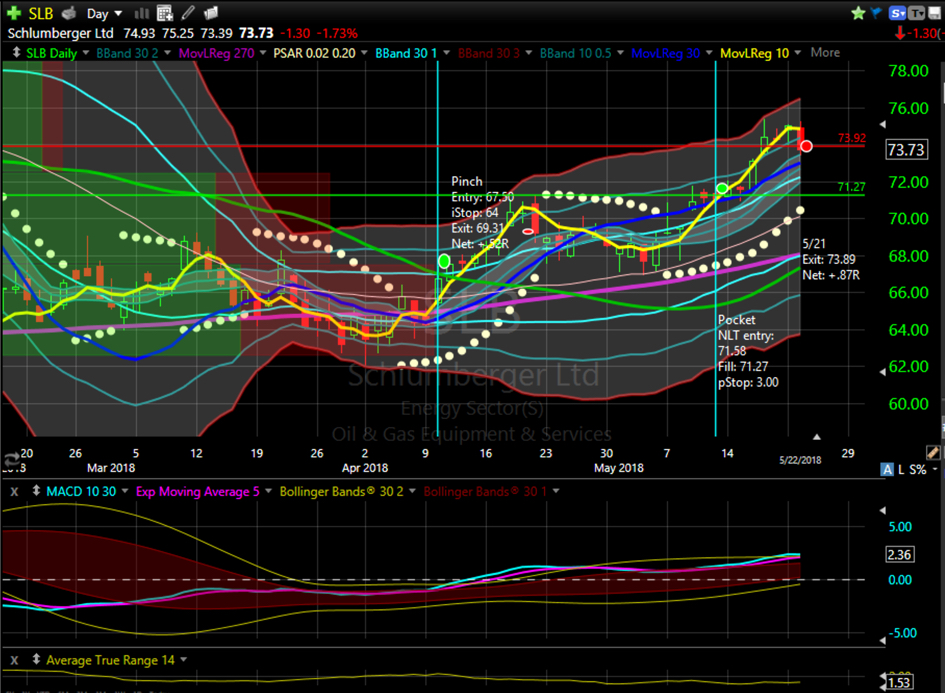

Long: AA(2), CAT, CBOE, CSCO, DIS, EWI(2), GILD, HD, IR, KR, MSFT, PFE, SLB, WYNN(2), XME.

Short: none.

Reflections

Because I hadn’t framed any trades, and I wasn’t sure there would be any that closed, I intended to write today about my belief that it is ok not to trade. I’m not sure it is a solid belief yet, but rather one I am still working on adding to my belief system.

What this means to me:

As an individual investor, I have no mandate to have my money in the market. I can be in cash, bonds, stocks, futures, currencies, any number of investment vehicles completely at my discretion. There is no prospectus indicating I must always be invested, preventing me from going short, or keeping me from using leverage. There are other beliefs or parts of me that are definitely interested in being in the market, and I certainly know that if I am going to generate any returns from trading, I must make trades. Even so, making trades does not mean I need to do so every day. I can wait for the setups and conditions that I believe will give me an edge.

What this belief gets me into:

It can make it easier to ignore market movements and neglect the daily tasks of trading. It allows me to pick trades that fit the edges I have developed. It could permit me to cherry pick from the trades my systems generate. It provides a sense of ease and loosens the grip on a belief that I need to be in the market.

What this belief gets me out of:

It can keep me out of the market. It can keep me from taking what could be some of the best trades available. It reduces my anxiety around trading and needing to generate results now.

Limitations of this belief:

Taken to the extreme, this would keep me from generating my desired results and achieving financial freedom through trading. It can encourage a less rigorous application of trading practices.

Utility of this belief:

This belief gives me more freedom with y pursuit of trading, lowering my stress, and enables me to focus on process rather than dollar results.

Conclusions:

There are other parts of me that are still not convinced of the absolute truth of this idea. I will need to do some parts exploration to identify and negotiate the difference of viewpoints between the parts interested in being in the market and the drive to succeed and become a successful trader. More will follow as the negotiations are conducted or other parts step into the foreground.